4 Shocking Things That Hurt Your Credit Score

If you're struggling to boost your credit rating, it's important to know ALL the triggers that negatively impact it. Follow our quick rundown of four scenarios that may surprise you!

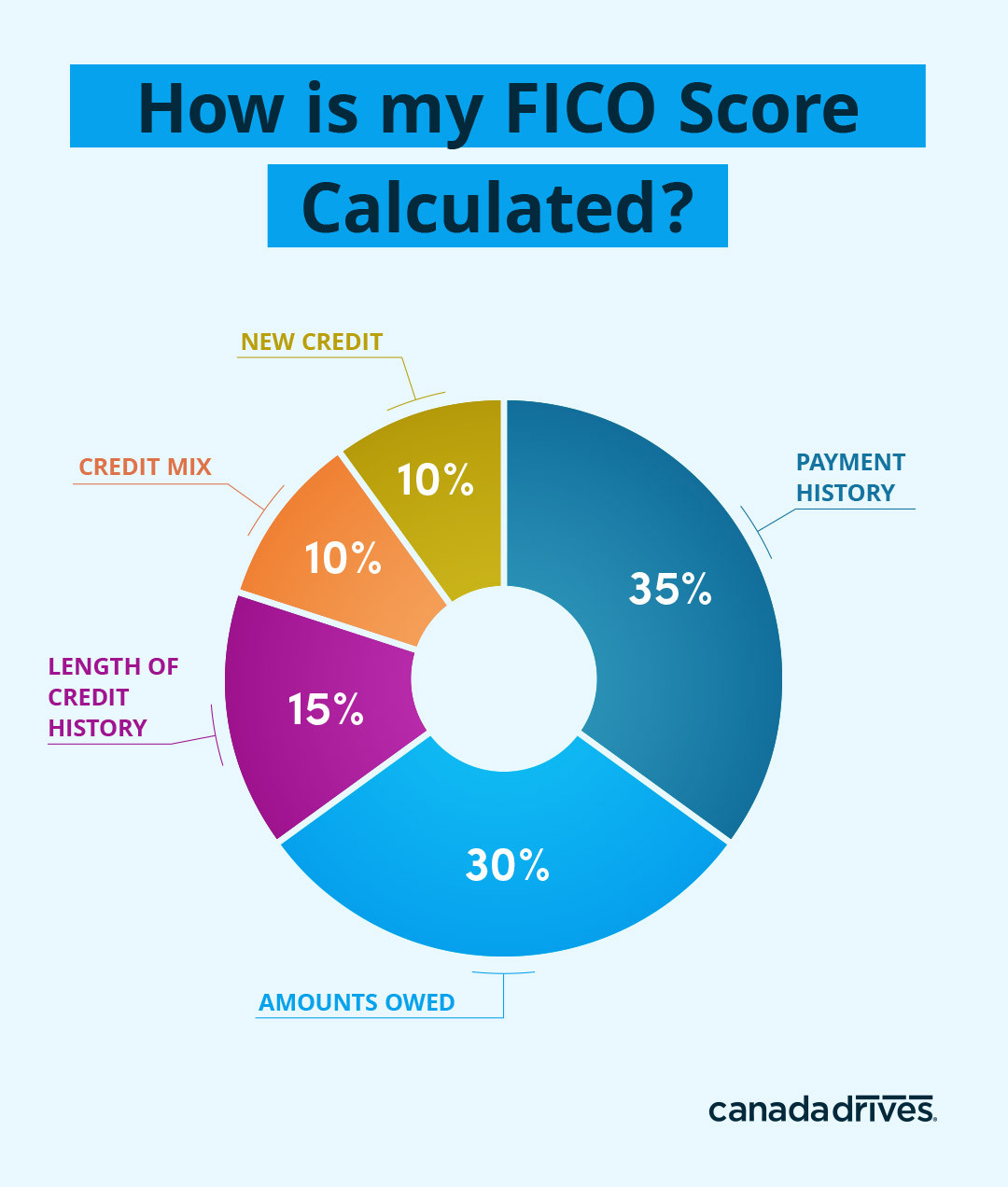

There are many different scoring models, but your credit score is generally calculated using five major criteria: length of credit history, payment history, new credit, credit mix, and amounts owed.

Factors that the credit bureaus use to calculate your credit score

Maybe you already know this, but due to this scoring model, there are some surprising scenarios that could hurt your credit rating!

1. You only have one credit card

Did you know that if you only have one type of credit, it can hurt your credit score? The types of credit (Credit Mix) you have account for 10% of your overall credit score as it demonstrates your ability to manage your debts as a whole.

One way to improve your credit would be to have a diversified range of credit products.

Pro Tip: As you look to boost your credit score, you may want to consider adding another type of loan product to your credit profile. It doesn’t mean you should apply for every loan or credit card you can get your hands on. You should be selective about the credit products you apply for and only apply for what you need.

If you need a new car, why not build your credit with a car loan? A car loan from Canada Drives can help you diversify your credit mix and positively impact your payment history.

Even if you have bad credit, we can help you get behind the wheel of a car you love within 48 hours!

2. You have an inactive credit card

Even if your credit card is in good standing, your credit issuer may opt to close this account due to inactivity.

Some credit issuers may even close inactive accounts without notifying you first. This is especially bad because closing an account will negatively impact your credit score.

As you can see in the chart above, 30% of your credit score is made up of Amounts Owed. In other words, how much you owe versus how much credit is available to you (AKA credit utilization). So if the credit card account closed had a credit limit of $5000, this is how much your available credit will drop which will increase your utilization ratio.

Pro Tip: One way to avoid this from happening is to use the credit card for a couple of purchases every month and ensure that you are paying off the balance on time. That way your credit issuer cannot close the account because it will become active again.

3. You want to close an old credit card account

Not only can closing an old account affect your utilization ratio, which makes up for 30% of your credit score, it also affects the length of your credit history, which accounts for 15% of your credit score.

Lenders like long credit histories; the longer the better. It helps them determine how much they can lend to you and what your interest rate should be. That’s why customers with no credit history traditionally have such a hard time getting approved.

If the average age of all your credit accounts combined has an impact on your credit rating, closing an old account will diminish the average age of your credit history.

Pro Tip: Don’t throw away your surplus credit cards. Keep them locked away, keep their balances clear, and only use them rarely.

4. You want to pay for a car rental with a debit card

As it turns out renting a car with a debit card can also be one of those rather surprising instances that can hurt your credit score. While most car rental companies require a credit card to pay, there may be others that will instead accept payments via a debit card.

If you decide to pay with a debit card, the rental company may pull your credit report with a hard inquiry to ensure that you are a reliable borrower.

A hard inquiry can decrease your credit score by a few points, and they remain on your credit report for up to 2 years.

Pro Tip: Avoid any unnecessary hard inquiries on your credit report. Use your credit card to pay for a rental car so that no inquiry needs to be made.

You can check your credit score for FREE

If you’re worried about your credit score, you can download and monitor your credit report for FREE thanks to Borrowell. Checking your credit score with Borrowell won’t hurt it, and they offer free credit improvement tips and education to help you become an expert in all things credit-related. Sign up in 3 minutes and take control of your personal finances with Borrowell!